Saving Devon & Cornwall First Time Buyers Time and Money

23 years of experience of helping first time buyers in Devon and Cornwall save time and money as they step onto the property ladder

5-Star Top Rated Adviser Based in Plymouth

Stress and Hassle Free Mortgages For First Time Buyers In Devon and Cornwall

This may be the most complex financial decision of your life - SWIFS guide you through the entire process, make it easy, and can even save you money!

Local expertise - we know the housing market inside out

Save on monthly repayments with our access to 100s of products and lenders

Save time with applications - we can apply for hundreds of deals at once

Eliminate the stress of a mortgage application with our team who have helped 100s step onto the property ladder

Always know how your home-buying journey is going with updates from our team

We save you time and money by researching and finding the best deal for your circumstances, eliminating needless paperwork and stress on your side.

We have 23 years experience of helping people in your situation through this journey. We know how important this moment is for you and we guide you along the way.

We remove stress from your journey by being with you from day one until you move into your first home. We deal with all parties and ensure everything moves along.

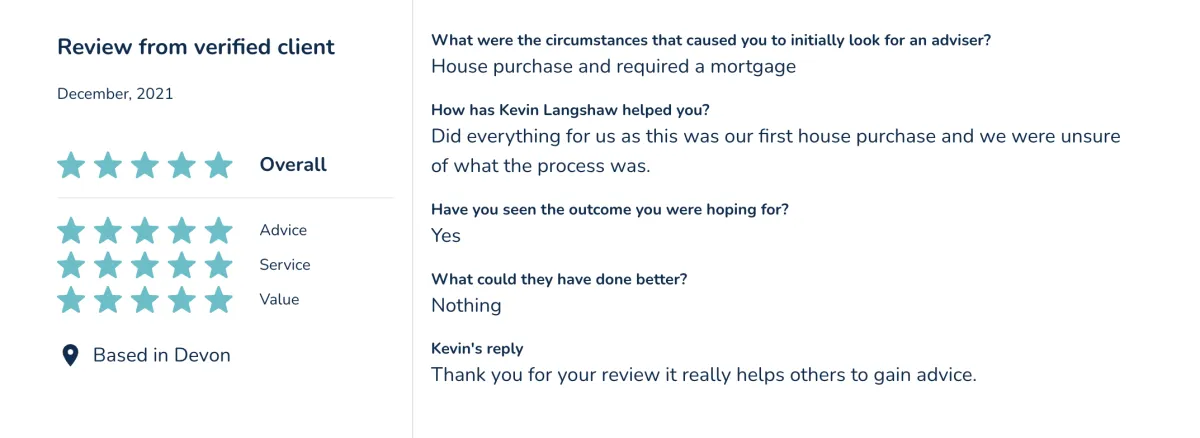

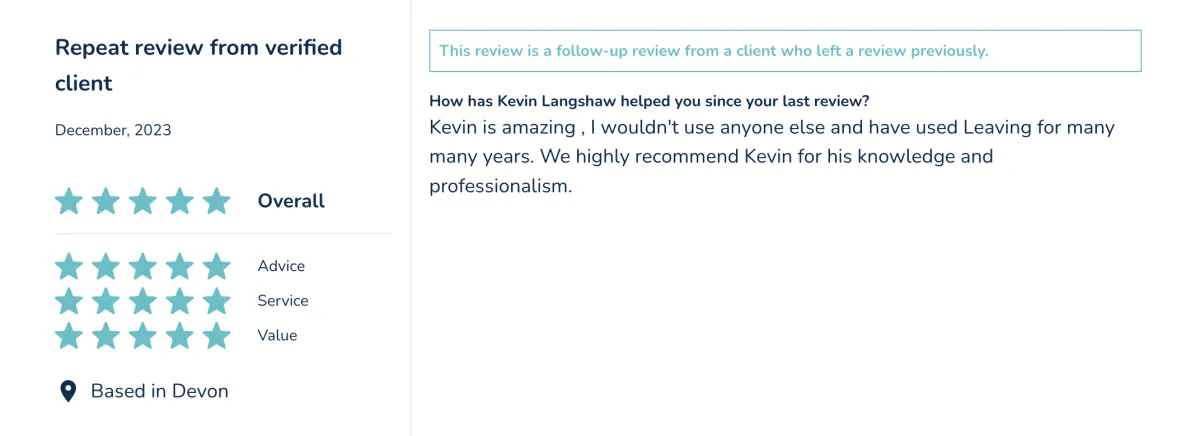

Don't Just Take Our Word For It...

Check out 5-star reviews from our happy clients!

Take The First Step To Owning Your First Home

Your First Time Buyer Guide and free consultation call with Kevin is one click away!

About SWIFS Mortgages

Kevin specialises in helping first time buyers in Devon and Cornwall realise their dreams of home ownership.

He ensures that first time buyers understand every step of the process until they exchange contracts on their new home.

Kevin values a personal touch with all his clients and he will visit you in the comfort and convenience of your own home, at a time that is convenient to you.

Over 23 years, he has helped 100s of people move onto the property ladder for the first time.

With his extensive career, Kevin is an expert in finding the best deals for each individual's circumstances.

With access to hundreds of products and lenders, you can be sure that we have access to the right deal for you.

How Does It Work?

Get Your First Home Pack

Fill out the form to download your first-home buyer's guide and a free consultation call with Kevin.

We Search For The Right Deal

We will arrange a time to visit and take some details to begin the search for your mortgage.

We Guide You All The Way

Kevin will help you choose the right deal and handle the entire application process for you.

Until Completion!

We stick with you from day 1 until the end, guiding you until you pick up the keys for your new home.

Completion FREE Extras

On the excitement of getting the keys some important things can get overlooked or put back a few weeks this can be expensive. We will come around and get you registered for council tax, water, utilities, and most importantly read the meters so you do not pay for something you have not used!

Why should I go to you over my bank?

We are whole-of-market brokers which means we have access to 100s of products and lenders. This means we can explore a wider range of deals that may be better suited to you and result in you saving money. If you go with your bank, you will be restricted to the products they have on offer. We shop around for you to help you get the best deal.

What is a deposit?

A deposit is a down payment you put towards the cost of a property you want to purchase. The higher your deposit, the less you will need to borrow. A larger deposit can also allow you to access better deals and have lower monthly repayments.

For example, if you wanted to buy a house for £300,000 and had a deposit of £30,000 (10%) your mortgage provider will lend you the remaining £270,000 (90%) of the purchase price. This is known as the Loan-to-Value (LTV). The remaining figure of £270,000 is the amount you will pay back across monthly instalments, until it is paid off in full.

How much can I borrow?

The amount of mortgage you can get depends on your income. As a rough guide, a typical multiple is four times your income. This figure could be higher or lower depending upon your individual circumstances and different lenders’ criteria. Some lenders do not use income multiples at all and will lend based on affordability.

Once you add to this the amount that you can afford to pay as a deposit, you have the amount you can pay for your first property. Some lenders offer very good deals for first time buyers, so it always worth asking us to research the market on your behalf.

What steps are involved?

Consultation with adviser: We will assess your circumstances to find the right mortgage for you.

Protection conversation: An essential not an extra, to ensure you are covered in the event of death, critical illness, or loss of income.

Decision/Agreement in principle: Following documentation checks, basic personal details will be submitted to the lender to see if you meet their criteria. A European Standardised Information Sheet or Key Facts Illustration will be provided detailing everything you need to know about a particular product.

Credit searches/application: The mortgage application can now be submitted to the lender who will undertake their own checks before approving the mortgage lending.

Valuation: You will need to pay for a valuation which enables the lender to check the value of the property. You should also consider appointing your own surveyor for a more in-depth survey to satisfy yourself that you are comfortable with the condition of the property.

Offer: Provided the lender is satisfied with the valuation, they will then issue a mortgage offer.

Legal work: The solicitor/conveyancer will then complete the searches and other aspects of legal work required in order to exchange contracts on the property purchase.

Exchange of contracts: At this point you will pay the agreed deposit and you are now legally committed to purchasing the property.

Payments: The solicitor will finalise all mortgage arrangements and agree a completion date. Other costs to be taken into consideration alongside the cost of the legal work undertaken will be land registry fees and potential stamp duty fees.

Completion: Funds are transferred by the mortgage lender to the solicitor and the purchase is completed. It’s now time to pick up the keys!

What other costs are there?

Stamp duty: Charged on UK land and property transactions. Stamp duty is calculated at different rates, with thresholds for different property types and transaction values. There are different rules if you are buying your first home. You can access stamp duty relief which means you pay less or no tax.

Legal Fees: For any purchase you will need a solicitor to complete all the legal work. The fee for this service can vary, but generally costs between £500 - £1200 +VAT.

Survey / Valuation Fee: All lenders will insist that a valuation is carried out on a property. The applicant pays for this but it is only for the benefit of the lender to check the property is suitable security for the amount they are lending. Valuation fees typically cost between £400 and £600 and will be confirmed by the lender.

What if I want to purchase in 3+ months time?

Even if you aren't planning on moving forward today, laying the groundwork with our team can be a helpful preliminary step to answer any questions you have and to advise you on your next moves. It can be very helpful to obtain a mortgage in principle, for example, before going to view houses as this will show the seller that you have the funds to purchase and are a serious candidate.

I have another question

Our First Home Pack will help you answer every question you have about purchasing your first home. The First Time Buyer Guide, written by Kevin, offers a comprehensive overview of moving onto the property ladder. You will also secure a free consultation call with Kevin, where you will be able to get expert guidance on how to move forward with your mortgage.

Get Your First Home Pack Today!

Fill out the form below to be sent your First Time Buyer Guide by email and secure a free consultation call with Kevin to answer all of your mortgage questions.

SWIFS is a trading name of Kevin Langshaw who is an Appointed Representative of Mortgage Intelligence Ltd which is authorised and regulated by the Financial Conduct Authority under 305330 in respect of mortgage, insurance and consumer credit mediation activities only.

The guidance and/or advice contained within this website is subject to the UK regulatory regime, and is therefore targeted at consumers based in the UK.

Your home may be repossessed if you do not keep up repayments on your mortgage or loans secured on it.

© 2024 SWIFS. All rights reserved.

This website is not part of the YouTube, Google, or Facebook website; Google Inc or Facebook Inc. Also, this website is NOT endorsed by YouTube, Google or Facebook in any way. FACEBOOK is a trademark of FACEBOOK Inc. YOUTUBE is a trademark of GOOGLE Inc.